Filing a workers’ compensation claim is a crucial step when injuries or illnesses occur at work. Successful claims typically result in regular benefit payments, but what if you need immediate access to your benefits? This guide explores workers’ compensation settlements, offering insights into types, processes, and potential tax considerations.

Understanding Workers Compensation Settlements:

Workers often seek settlements for upfront benefits, mitigating the risk of premature benefit payment termination. However, deciding when to settle is a nuanced choice, demanding guidance from a seasoned lawyer to ensure the best outcome.

What is a Workers Comp Settlement?

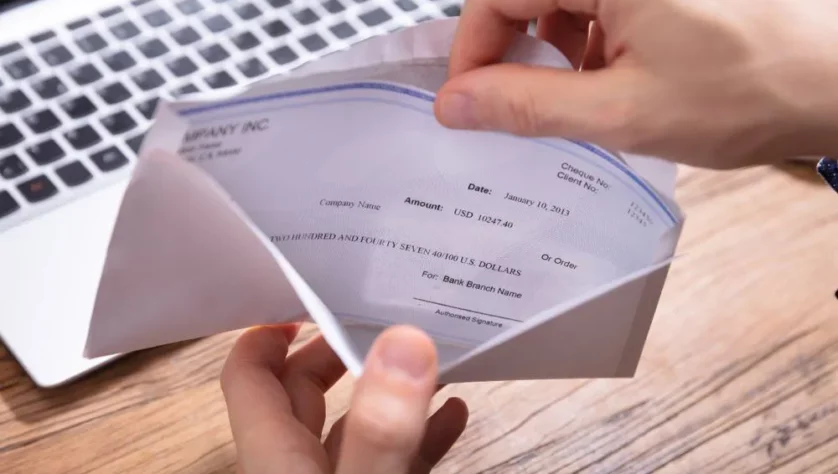

A workers compensation settlement resolves a claim in a lump sum, foregoing periodic benefit payments. This agreement involves negotiating with the employer or their insurance company, leading to upfront benefits in exchange for relinquishing the right to seek additional compensation.

Types of Workers Comp Settlements:

Workers compensation settlements can take various forms to suit individual needs:

1. Partial Settlement Agreement:

Covers specific benefits while leaving others open.

Commonly involves a lump-sum payment for disability benefits with ongoing medical coverage.

2. Lump-Sum Full Settlement:

Negotiates a one-time payment for the total owed amount.

Terminates eligibility for any further workers’ compensation benefits.

3. Structured Full Settlement:

Involves payments spread over time, providing financial security.

Guarantees structured settlement payments per the agreed-upon terms.

4. Settlement of Amount in Dispute:

Resolves only the disputed amount for past-due benefits.

Allows for a lump-sum payment while continuing eligibility for ongoing benefits.

Choosing the right type depends on individual circumstances, financial needs, and future uncertainties, necessitating expert advice.

Process for Obtaining a Workers Comp Settlement:

The steps to secure a workers compensation settlement involve timely reporting of the injury, seeking treatment, hiring an attorney, calculating entitlements, and negotiating with the employer or insurer. A proactive approach, including legal representation, is crucial to maximize settlement outcomes.

Tax Implications of Workers Compensation Settlements:

Generally, workers’ compensation settlements are not taxed, mirroring the tax treatment of regular benefit payments. However, exceptions exist, and potential tax liabilities may arise, especially concerning Social Security benefits. Seeking guidance from an experienced attorney is essential to navigate potential tax implications.

Navigating the complexities of workers’ compensation settlements requires informed decision-making and expert legal guidance. Whether pursuing a lump-sum or structured settlement, understanding the nuances of the process and potential tax considerations is paramount. For personalized advice and assistance, contact a local attorney for a free consultation.